ETH Price Prediction: Analyzing the Path to New Highs

#ETH

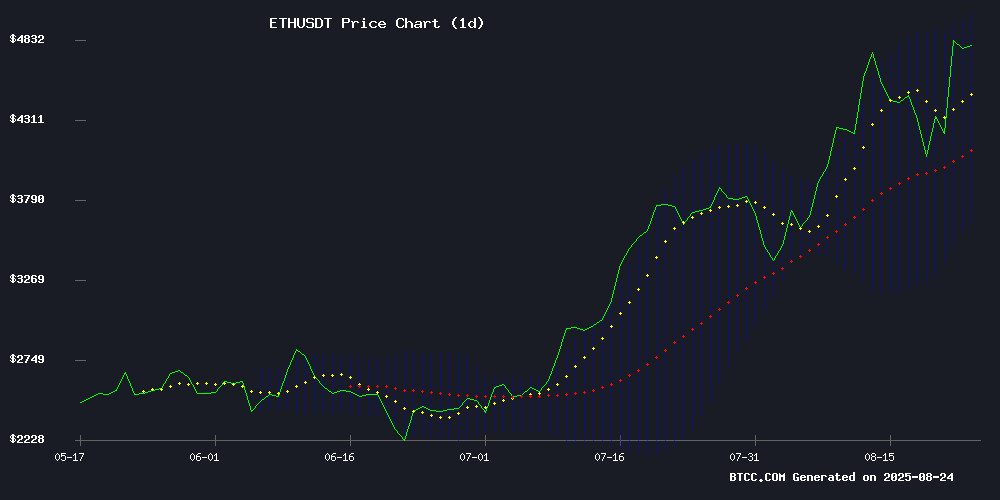

- Technical Breakout: ETH trading significantly above its 20-day moving average with positive MACD momentum indicates strong bullish technical structure

- Institutional Validation: High-profile endorsements and Ethereum surpassing traditional financial giants in market cap provide fundamental support

- Resistance Levels: Upper Bollinger Band at $5,004.50 presents near-term resistance, with break above potentially accelerating gains toward $5,500

ETH Price Prediction

Technical Analysis: ETH Shows Strong Bullish Momentum

ETH is currently trading at $4,785.80, significantly above its 20-day moving average of $4,325.81, indicating strong bullish momentum. The MACD reading of 10.0556 shows positive momentum building, while the price trading NEAR the upper Bollinger Band at $5,004.50 suggests potential resistance ahead. According to BTCC financial analyst William, 'The technical setup supports further upside, with a clear break above $5,000 potentially opening the path toward $5,500 levels.'

Market Sentiment: Ethereum Gains Institutional Validation

Positive news flow continues to support ETH's rally, with headlines highlighting ethereum flipping Mastercard in market capitalization and Peter Thiel's strategic bets amplifying market momentum. BTCC financial analyst William notes, 'The combination of institutional validation and mainstream adoption stories is creating a perfect storm for ETH. The news sentiment aligns with our technical view that Ethereum is positioned for further gains, though investors should monitor for potential volatility near record highs.'

Factors Influencing ETH's Price

Ether Nears Record Highs as Bullish Forecasts Spotlight ETH Exposure Strategies

Ether (ETH) is trading near all-time highs at $4,783, fueling speculation about its trajectory. Fundstrat's Tom Lee projects a $15,000 target by end-2025, citing Ethereum's expanding role in stablecoins, DeFi, and real-world asset tokenization.

Direct ownership remains the purest play, offering unfiltered access to staking and decentralized applications. Meanwhile, spot ETH ETFs are emerging as a regulated gateway for traditional investors, with staking features under regulatory review.

Peter Thiel’s Strategic Bets Amplify Ethereum’s Market Surge

Billionaire entrepreneur Peter Thiel’s investment firms are reaping substantial rewards from Ethereum’s 13.5% June rally. Founders Fund, his venture capital arm, holds significant stakes in ETHZilla and Bitmine Immersion Technologies—companies that have pivoted aggressively toward Ethereum exposure. ETHZilla’s market capitalization exploded from $18 million to $741 million post-announcement, while Bitmine Immersion Technologies surged over 1,000% to $8.3 billion.

The bets reflect Thiel’s conviction that Ethereum will penetrate traditional finance infrastructure. His biotech-to-crypto pivot with ETHZilla mirrors a broader trend of institutional capital flowing into smart contract platforms. Market observers note these moves coincide with growing corporate experimentation with Ethereum-based settlement systems and tokenized assets.

Ethereum Investors Spark Potential Market Turnaround

Ethereum's price has faced a 6.2% decline over the past week, yet stability emerges as it edges up 0.1% in the last 24 hours. On-chain metrics and technical patterns suggest a brewing shift in market sentiment.

Short-term holders are re-entering the market aggressively—wallets holding ETH for 1-7 days surged 67% in share since August 8. The SOPR indicator flirts with historical lower bounds while an inverse head-shoulders pattern forms on charts, both classic reversal signals.

Coinpedia Digest: This Week’s Crypto News Highlights | 23rd August, 2025

Federal Reserve Chair Jerome Powell's Jackson Hole speech hinted at potential rate cuts while emphasizing inflation vigilance. The policy rate is now 100 basis points closer to neutral, but Powell warned of persistent risks from tariffs and labor market strains. "We will not allow a one-time increase in the price level to become an ongoing inflation problem," he stated, underscoring the Fed's delicate balancing act.

Ethereum surged to a record high above $4,878 following Powell's dovish signals, overtaking Mastercard as the 22nd largest global asset. Spot ETH ETFs now manage over $20 billion, with institutional adoption accelerating. Nate Geraci framed Ether as "the backbone of future financial markets" amid growing corporate treasury demand.

ETH Flips Mastercard, Now 22nd Largest Asset

Ethereum has surged past Mastercard in market capitalization, securing the 22nd position among global assets. The milestone follows a robust August rally, fueled by escalating demand and growing institutional interest.

Crypto's encroachment on traditional finance benchmarks continues unabated. While rankings remain fluid, Ethereum's current momentum underscores its disruptive potential in heavyweight financial circles.

How High Will ETH Price Go?

Based on current technical indicators and market sentiment, ETH appears poised for further gains. The price trading above key moving averages and positive MACD momentum suggest potential upside toward the $5,200-$5,500 range in the near term. However, resistance near the upper Bollinger Band at $5,004.50 may cause temporary consolidation.

| Indicator | Current Value | Implication |

|---|---|---|

| Current Price | $4,785.80 | Strong bullish position |

| 20-day MA | $4,325.81 | Price well above support |

| Upper Bollinger | $5,004.50 | Near-term resistance |

| MACD | 10.0556 | Positive momentum |

BTCC financial analyst William suggests that breaking above $5,000 could trigger additional buying momentum, potentially targeting the $5,500 level based on technical extensions and current market sentiment.